irs child tax credit 2022

The EITC is generally available to workers without qualifying children who are at. The American Rescue Plan Act ARPA of 2021.

The Irs Will Be Sending Parents Monthly Payments In One Week Wfmynews2 Com

Web FAMILIES can grab payments of up to 3600 from the increased Child Tax Credit in 2021 until November 17 due to an IRS mistake.

. Web Millions of taxpaying American parents will see the federal credit revert back to 2000 per child this year. Web Enhanced child tax credit. Web There is no upper age limit for claiming the credit if taxpayers have earned income.

Web November 15 2022 2. Web Those changes were made for only one year however and the payments will revert back to 2000 per child in 2023 CBS Los Angeles reported. Web IR-2022-199 November 15 2022.

Web The Child Tax Credit helps families with qualifying children get a tax break. Web March 11 2022 516 AM 2 min read. It also made existing tax credits the child tax and earned income.

The Empire child tax credit. Web Rhode Island residents can similarly claim 250 per child and up to 750 for three children in a new initiative that has started this month. Web To be eligible for advance payments of the Child Tax Credit you and your spouse if married filing jointly must have.

Web In Rhode Island families will get 250 per child and a maximum of 750 total for up to three children with direct payments going out beginning in October. Filed a 2019 or 2020 tax return and claimed. Web The Child Tax Credit under the American Rescue Plan rose from 2000 to 3000 for every qualified child over the age of six and from 2000 to 3600 for each.

You can use your username and. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021. Up to 3600 per child or 1800 if you received payments on a monthly basis in 2021.

This is in line with the program offered before the 2021. You may be able to claim the credit even if you dont normally file a tax return. Web Child Tax Credit 2022 Families can claim direct payments worth up to 3600 due to IRS mistake see if you qualify.

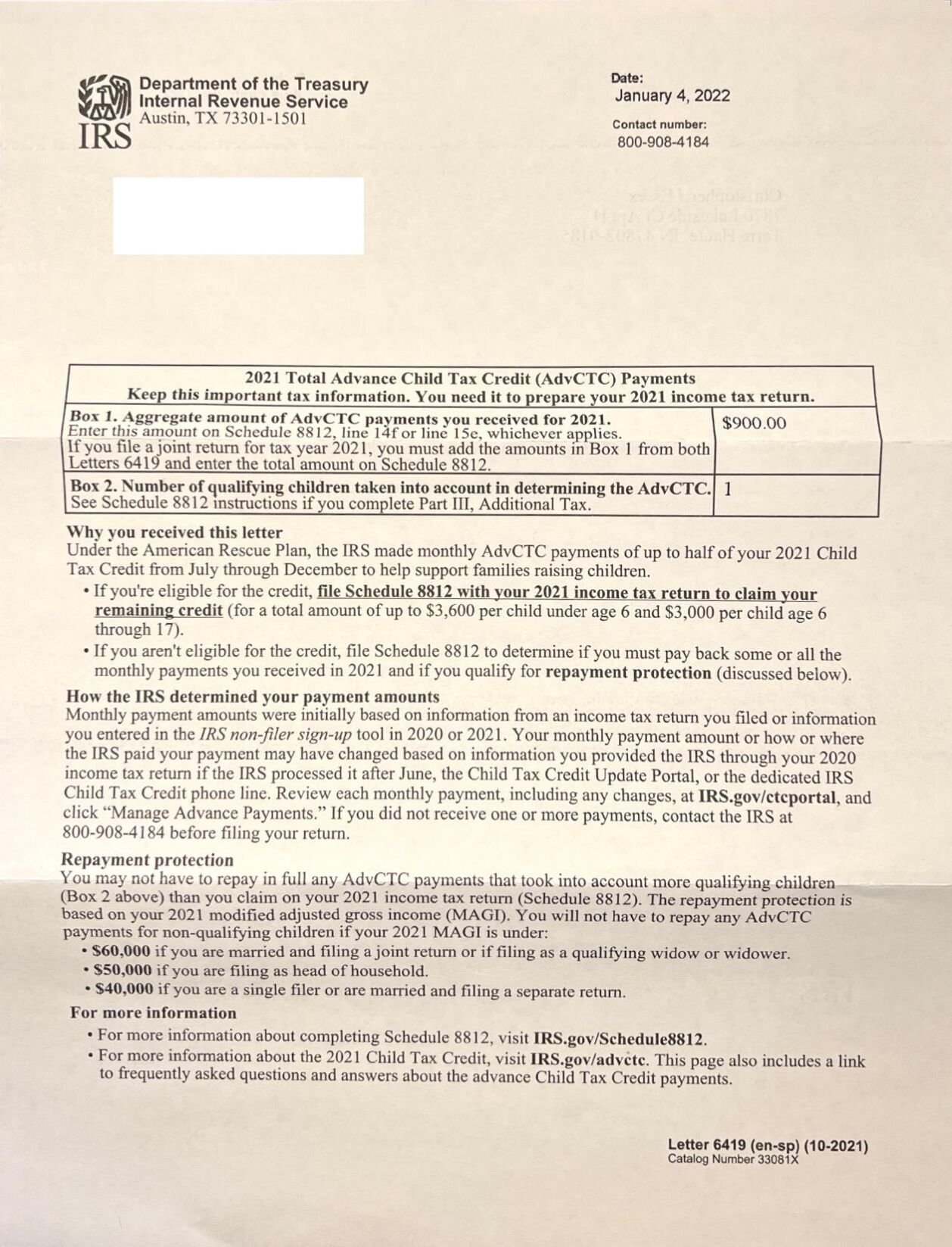

Web Get your advance payments total and number of qualifying children in your online account and in the Letter 6419 we mailed you. These FAQs were released to the public in Fact Sheet 2022-28 PDF April 27 2022. Web The maximum child tax credit amount will decrease in 2022 In 2021 the enhanced child tax credit meant that taxpayers with children ages 6 to 17 could get a.

Web Enhanced child tax credit. Web The advance Child Tax Credit payments disbursed by the IRS from July through December of 2021 were early payments from the IRS of 50 percent of the. The credit can be as much as 1502 for workers with no qualifying children.

Web That included a Recovery Rebate Credit that provided third stimulus checks of 1400 per person. Web There are also changes that can help low- and moderate-income families with children. Web Businesses and Self Employed.

IRS issued a statement reminding. The IRS recently revised the 2021 Child Tax Credit and Advance Child Tax Credit Payments Frequently. A recent report from The.

17 to complete a simplified tax return to claim your missing stimulus or child tax credit money. 1200 sent in April. The IRS Free File site is staying open.

If you havent yet. Sent in April 2020 for 1200. Web Taxpayer income requirements to claim the 2022 Child Tax Credit Parents of eligible children must have an adjusted gross income AGI of less than 200000 for.

WASHINGTON The Internal Revenue Service today reminded those who still need to file their 2021 tax returns that IRS Free.

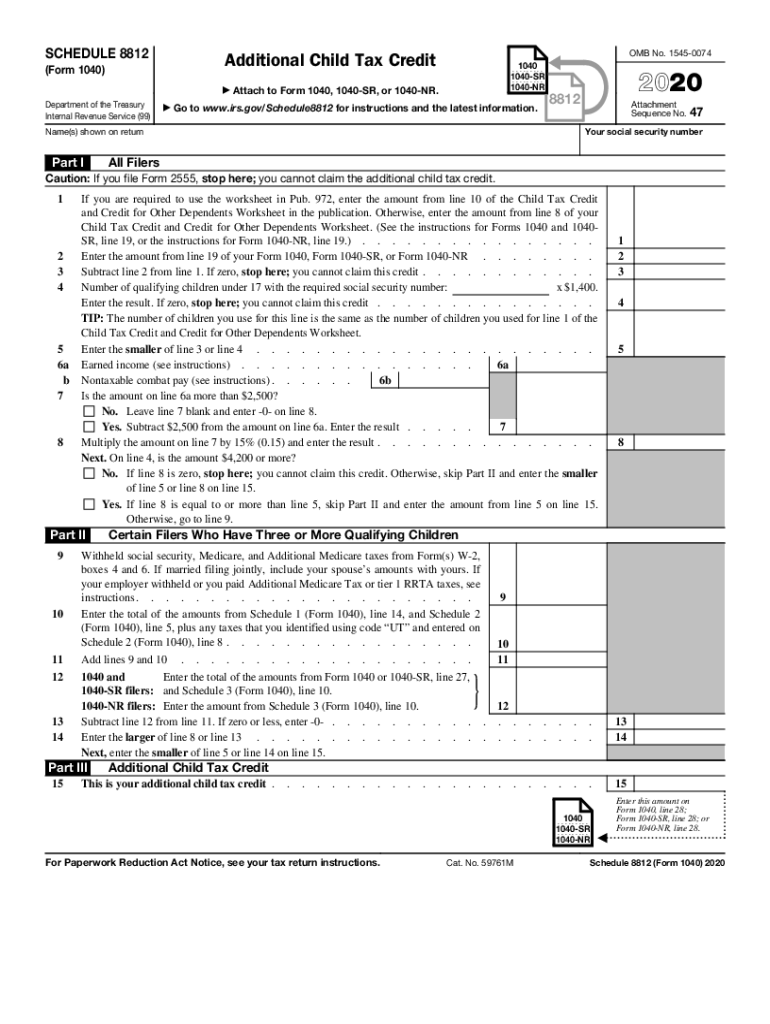

Child Tax Credit Schedule 8812 H R Block

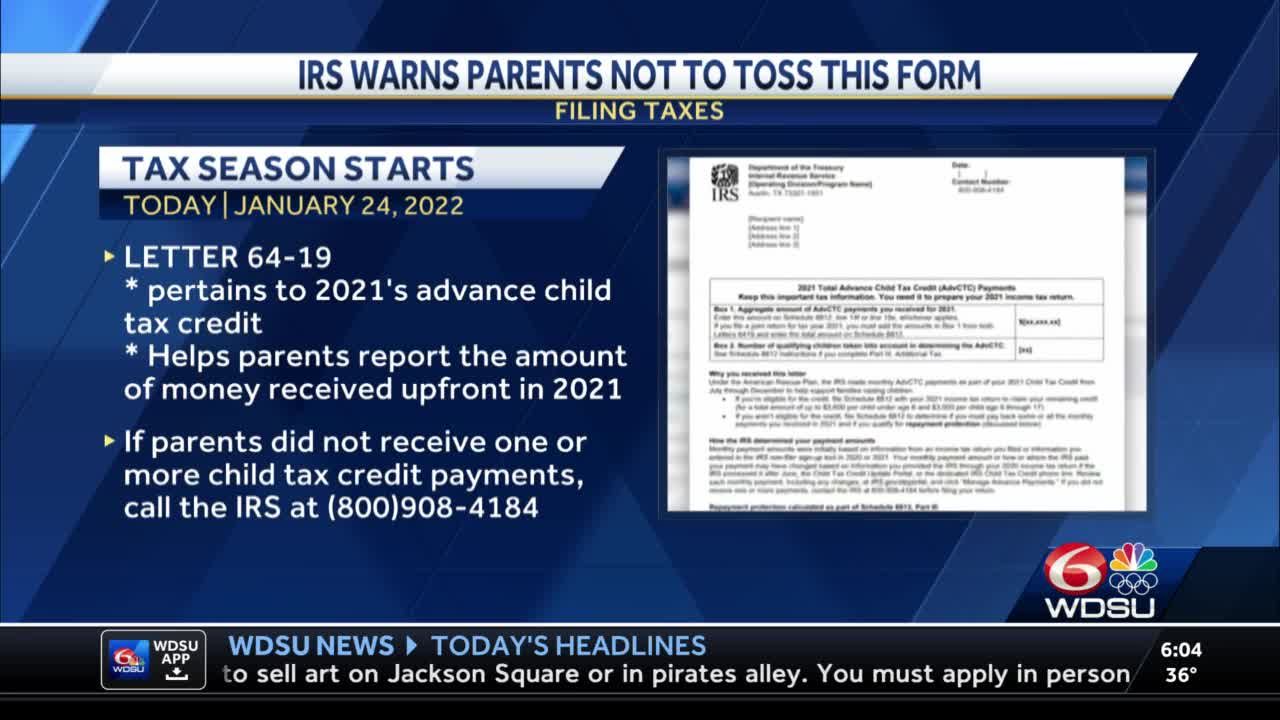

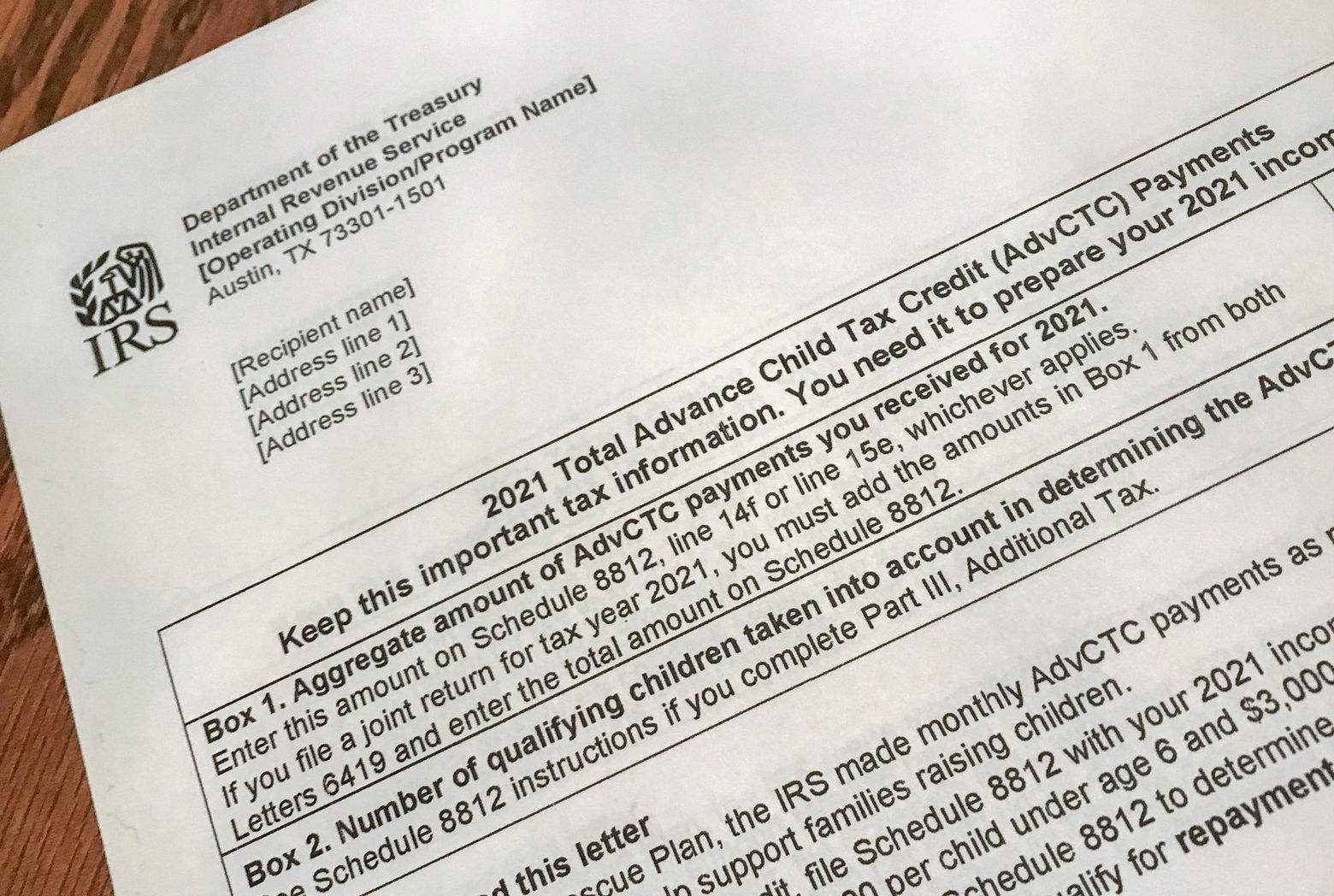

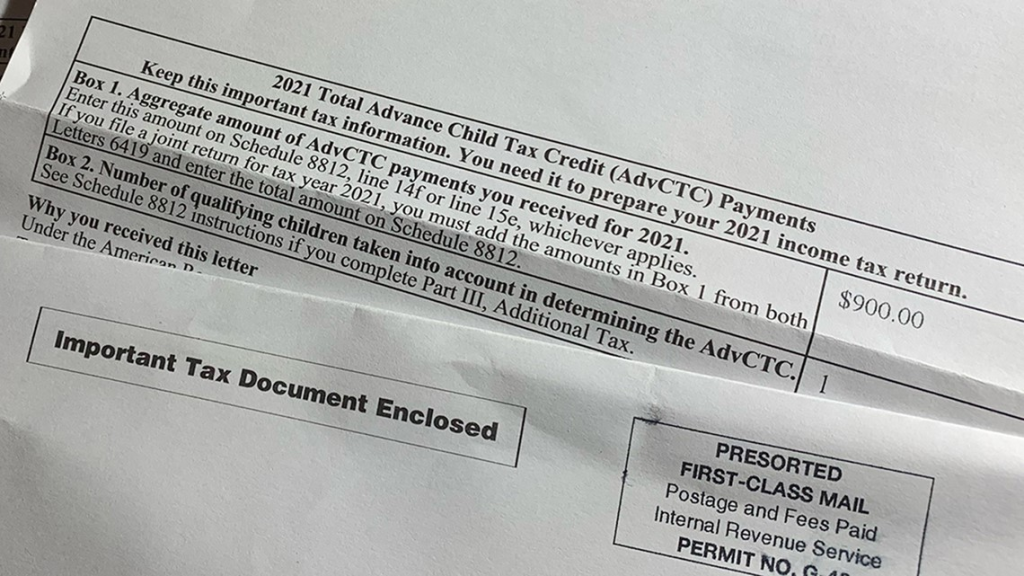

Irs Urges Parents To Not Throw Away Child Tax Credit Letter

Child Tax Credit 2022 Are Ctc Payments Really Over Marca

Irs Sent 1 1 Billion In Child Welfare Payments To The Wrong People

Clearing Up Confusion Surrounding Changes To Child Tax Credit

Child Tax Credit 2021 2022 What To Know This Year And How To Claim Your Refund Wsj

2022 Irs Tax Refund Dates When To Expect Your Refund

Irs Child Tax Credit 2022 Deadline In Six Days As Families Push For Batch Of 300 Payments In January The Us Sun

Child Tax Credit When Is The Deadline To Claim Up To 3 600 Marca

Feds Launch Website To Claim 2nd Half Of Child Tax Credit Ktla

Expired 2021 Child Tax Credit Cut Child Poverty Nearly In Half Ct News Junkie

Child Tax Credit Here S What To Know For 2022 Bankrate

Child Tax Credit Calculator How Much Will You Get From The Expanded Child Tax Credit Washington Post

Tax Season 2022 Tips For A Speedy Refund And How To Avoid Gumming Up The Works The Seattle Times

Irs En Espanol On Twitter Many Families With Children In Puertorico Are Eligible To Claim The Child Tax Credit For The First Time Irs Urges Them Claim This Valuable Benefit See Https T Co Mfxauuh8de

Tax Refund Update Irs Releasing Refunds W Child Tax Credit Payout Dates For 2022 Social Security Youtube

What Is Irs Letter 6419 And Why Does It Matter Before You File Taxes Where S My Refund Tax News Information

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back